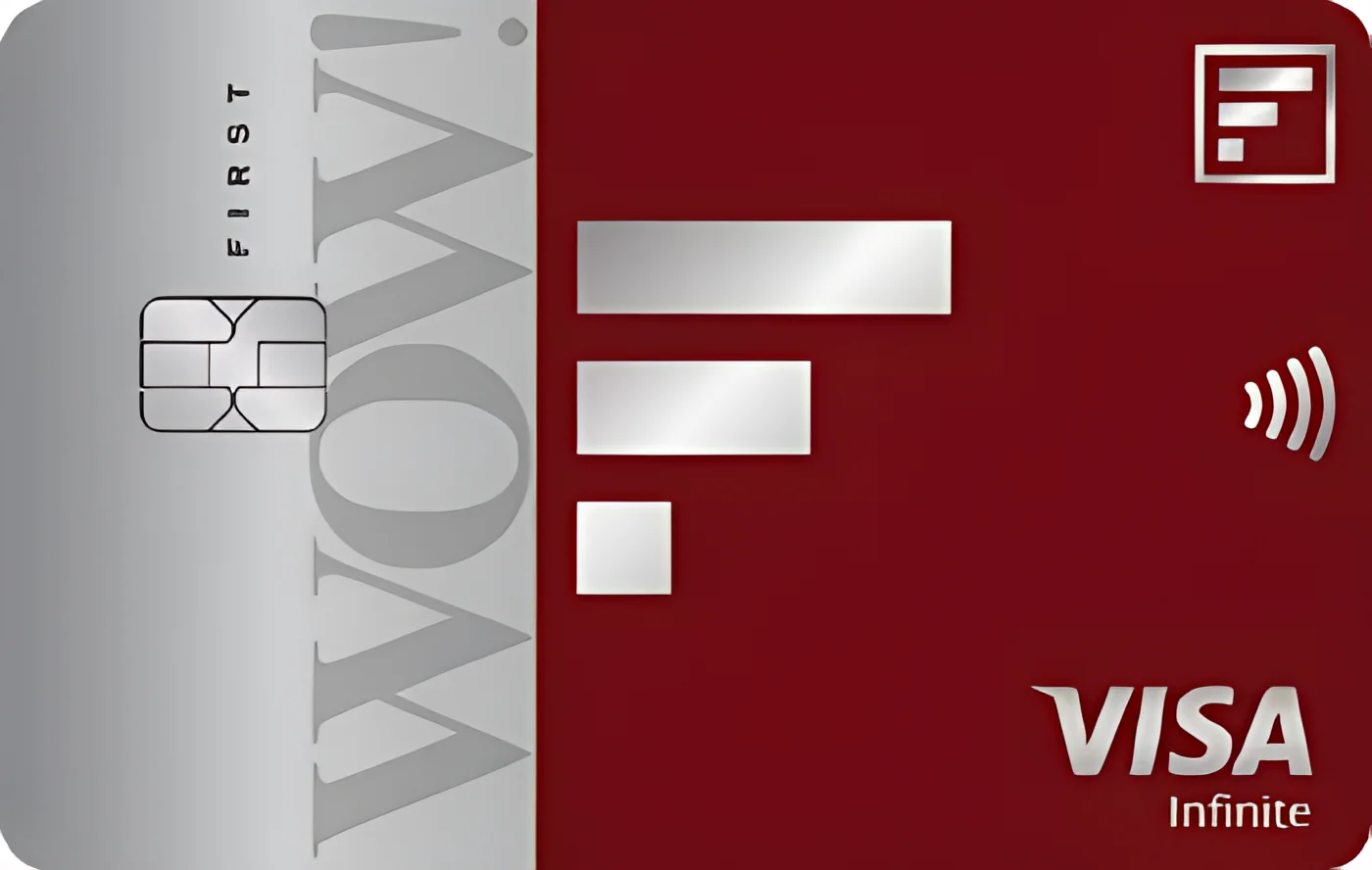

Are you looking for a credit card that will let you save money on international transactions as well as earn great rewards? The IDFC First Wow Credit Card could be the ideal choice for you. Launched as India’s first credit card with zero foreign exchange markup charges, this secured card is designed for frequent travelers, online shoppers, and all those who want a hassle-free financial instrument. In this review, we will discuss in-depth its features, pros and cons, suitability, and reasons why it will remain trending in 2024.

| Joining Fee | Nil |

| Annual Fee | Nil |

| Add-on Card Joining and Annual Fee | NA |

| Interest Rate on Purchases, Cash Advances and outstanding balances due | Monthly Rate - 0.71% - 3.85% Annual Rate - 8.5% - 46.2% |

| Overdue Interest | Monthly Rate - 3.99% Annual Rate - 47.88% |

| Late payment charges | 15% of Total Amount Due as of the previous statement minus any payments received before the due date (subject to a minimum of Rs. 100 and a maximum of Rs. 1,300) |

| Over-limit charges | Nil |

| Return of cheque/Auto-Debit SI/Payment Return | 2% of Payment amount subject to a minimum of Rs. 500 |

| Reward Redemption Fee | Rs. 99 per redemption transaction |

| Fee on cash payment at branches | NIL |

| Outstation cheque processing fee | NIL |

| Duplicate statement request | NIL |

| Card replacement fee | Rs. 199 |

| Cheque/Cash processing fee | NIL |

| Charge slip request | NIL |

| Balance Transfer Processing fee | Processing fee on Balance transfer transaction will be communicated at the time of the transaction |

| Markup Charges on Foreign currency transactions and Dynamic & Static Currency Conversion Transactions | Nil |

| Instalment Products related fees and charges | Processing fee, Interest Rate and Pre-closure fee applicable on the below mentioned Instalment products will be communicated at the time of the transaction/ conversion: 1) Transaction(s) converted to EMIs 2) Balance Transfer converted to EMIs 3) Outstanding Balance converted to EMIs 4) Loan on Credit Card |

| Fuel Surcharge Waiver | Maximum Rs. 199 of Fuel Surcharge waiver per statement cycle (1% Fuel Surcharge Waiver on Fuel Transactions value between Rs. 200 and Rs. 5000) |

| Rent and Property Management Fee | 1% of transaction value, subject to minimum of Rs. 249 per transaction |

| Education Payment Fee | A fee of 1% of the transaction amount subject to a minimum of Rs. 249 will be applicable on education payments made through third-party apps |

| Goods and Service Tax (GST) | 18% is applicable on all fees, interest and other charges and is subject to change. |

Users praise the IDFC WOW Card for its zero forex charges and seamless international transactions. The FD-backed security makes it accessible for those with limited credit history. However, some users note the rewards could be more competitive.

Yes! Since it’s FD-backed, students without income proof can apply.

Yes, no markup fees. Only the base exchange rate applies.

No. The FD remains locked until you close the credit card.

Responsible usage improves your CIBIL score.

The IDFC FIRST WOW Credit Card is a game-changer for international spends and credit-building. While its rewards are modest, the zero forex markup and FD-backed flexibility make it a must-have for travelers and cautious spenders. Apply today if you value transparency and global convenience!